What Is CCI ?

Donald Lambert, a technical analyst, created the CCI, or Commodity Channel Index, which was first published in Commodities magazine (now Futures) in 1980. Despite its name, the CCI indicator is not limited to commodities and may be employed in any market. The CCI was created to detect long-term trend shifts, but traders have modified it for use on various markets and timeframes. For active traders, trading with different periods delivers additional buy or sell signals. Traders frequently use the CCI to identify the prevailing trend on longer-term charts and to pinpoint pullbacks and produce trade signals on shorter-term charts.

What Is the CCI Indicator Formula

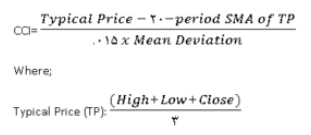

The following example is based on a Commodity Channel Index (CCI) computation across 20 periods. The Simple Moving Average and Mean Deviation are likewise calculated using the number of CCI periods.

The Mean Deviation is calculated in four steps:

To begin, deduct each period’s normal price from the most recent 20-period average of the typical price. Take the absolute values of these integers in the second step. Finally, add up the absolute values. Fourth, divide the total number of periods by the total number of periods (20).

Lambert chose.015 as the constant to ensure that around 70% to 80% of CCI values lie between -100 and +100. This proportion is also affected by the time period under consideration. With a smaller percentage of values between +100 and -100, a shorter CCI (10 periods) will be more volatile. A longer CCI (40 periods), on the other hand, will have a greater percentage of values between 100 and 100.

How Does CCI Indicator Work?

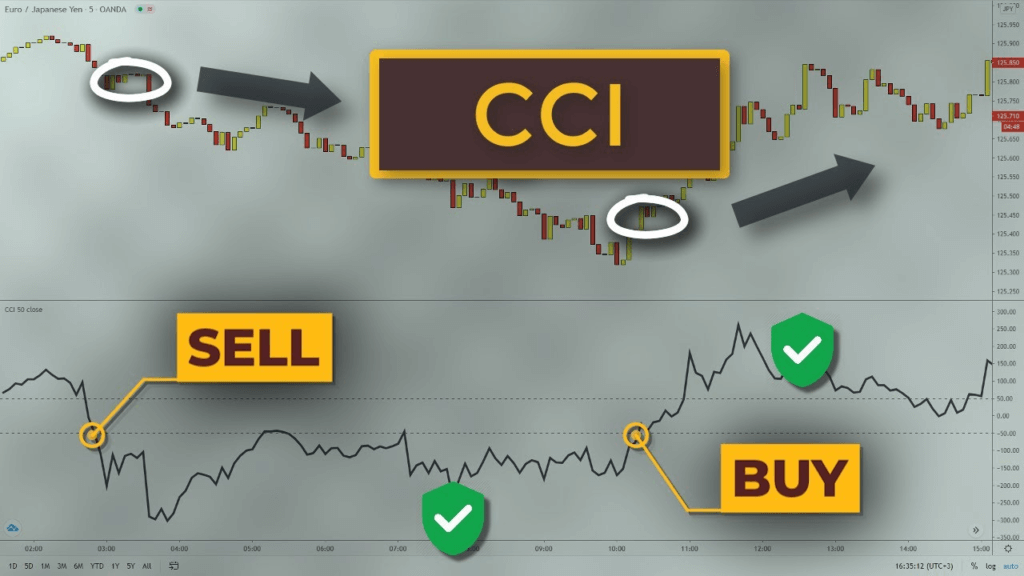

The difference between a security’s price change and its average price change is measured by CCI. Positive values over zero suggest that prices are considerably above their average, indicating strength. Low negative values suggest that prices are significantly lower than their average, indicating weakness.

The CCI (Commodity Channel Index) can be employed as a leading or coincident indicator. Surges over +100, as a coincident indicator, imply significant price movement that might suggest the commencement of an uptrend.

Plunges below -100 indicate sluggish market activity, which may indicate the start of a downturn. Chartists might use overbought or oversold circumstances as a leading indicator to predict a mean reversion. Bullish and bearish divergences, on the other hand, may be used to spot early momentum shifts and predict trend reversals.

Overbought and Oversold Identification By CCI

Using the Commodity Channel Index (CCI) or any other momentum oscillator to identify overbought and oversold levels can be difficult. CCI is an unbound oscillator, for starters. There are no theoretical upper or lower bounds. As a result, determining whether a stock is overbought or oversold is subjective.

Second, once an indicator becomes overbought, equities might continue to rise. Similarly, when an indicator becomes oversold, securities might continue to fall. The Commodity Channel Index uses a different definition of overbought and oversold (CCI). In a trading range, 100 may be sufficient, but in other instances, more severe levels are required. 200 is a significantly more difficult level to accomplish and represents a real extreme. The volatility of the underlying securities influences the choice of overbought/oversold thresholds. The CCI range for an index ETF like SPY is generally less than the CCI range for most equities like Google.

Google (GOOG) with CCI is seen in the graph above (20). Using the advanced indicators settings, horizontal lines of 200 were created. Google topped 200 at least five times between early February and early October 2010. When CCI went back below +200, the red dotted lines appeared, and when CCI moved back above -200, the green dotted lines appeared. If the trend continues, it is critical to wait for these crossings to reduce whipsaws. However, such a system is not without flaws. Notice how Google continued to rise even after the CCI got overbought and fell below -200 in mid-September.

Bullish and Bearish Divergence Identification By CCI

Because directional momentum does not confirm price, divergences signify a possible reversal point. When the underlying security makes a lower low, and the CCI makes a higher low, the underlying security exhibits less negative momentum.

A bearish divergence happens when the security makes a higher high while the CCI makes a lower high, indicating that the security has less upward momentum. Before you get too enthusiastic about divergences as reversal signs, keep in mind that they may be deceptive in a strong trend. Before a top forms, a strong uptrend might display a number of bearish divergences. Bullish divergences, on the other hand, are common in protracted downtrends.

Scanical; Your Smart Indicator Which Benefits You Infinitely

Nothing can be foolproof, but as long as CCI is applied appropriately, it may be a useful indicator that can produce solid trade indications. To avoid potential losses caused by erroneous signals, adjust the CCI settings, such as the number of periods and the trading method. Scanical is here to guide you in your stock journey.