Importance of Having a Trading Bot

Trading bots enable investors (crypto, Forex, and stock) to automate the acquisition and disposition of holdings depending on important technical indicators. Bots execute specified trading methods with the goal of achieving the greatest “win rate,” or the proportion of winning trades, in order to win the competition. Some techniques rely on the crossing of particular moving averages, which may be used to automatically initiate buys and sells. Our guide for beginners will assist you in learning more about trading bots and will introduce you to a few of our best trading bots that are presently available on the market. Continue to follow this blog and create a trading bot at Scanical.

Why Every Investor Needs to Create a Trading Bot

To create a trading bot for yourself doesn’t mean that you need to be a computer expert! You may use several ready-to-go trading bots like Scanical that help to win every trade you make. Before introducing you to how to create a trading bot, let’s talk about the services that trading bots provide and their benefits.

Bots are more efficient than humans and make fewer mistakes, leaving little opportunity for emotion or sentiment. This is particularly useful given the crypto market’s (and other markets’) history of wild price swings. Algorithmic trading bots, according to estimates, account for 70-80% of total crypto trading activity. If you hesitate to create a trading bot for yourself, read the next section below!

- Better Data Analysis with Trading Bot: Raw market data from a number of sources is scanned and interpreted by trading bots, which then choose whether to buy or sell. Many trading bots allow users to tailor the sorts of data that are collected in order to deliver more detailed results

- Predict Risks with a Trading Bot: This is a very important characteristic of a trading bot. Bots use market data to determine the possible risk associated with a certain asset. This information assists the bot in determining how much money to invest or trade with

- Buy and sell Assets Consciously with a Trading Bot: Trading bots make use of API keys (Application Program Interface) to purchase and sell bitcoin assets in a planned manner. The API key serves the same purpose as a password, and your trading bot will need it in order to run your account and execute bitcoin orders. The usage of this method is advantageous when you do not want to acquire tokens in quantity

How to Create a Trading Bot (In Python)

When you use a trading bot, you are connecting your computer to your chosen exchange’s API in order to communicate with it automatically and execute trades on your behalf depending on the data it has gathered from the market. When the market situation fulfills a predetermined set of conditions, the bot will purchase or sell an asset.

As a starting point, every function that has been annotated with our schedule decorator is executed at a certain time interval and is given symbol data. These annotated functions are referred to as handlers in this document, although you may name them anything you like.

They just need to consider two counter-arguments. The first one is referred to as status and the second one as data. If you provide a period of time for the second parameter, the symbol data for that interval will always be sent to it. For the sake of this specific bot, we trade at 1-hour candle intervals, and we provide a trading symbol, which is BTCUSDT in this case. Of course, it is possible to trade on many symbols at the same time!

Steps to create a trading bot

To begin, establish two exponential moving averages (EMA), one with a longer look-back duration of 40 candles and another with a longer look-back period of 20 candles. This is the first stage in the design of your algorithm. After that, you get a current picture of your portfolio, on which the bot is now trading, which includes information on the current balance of your quoted asset, USDT. This is the second phase.

The latter guarantees that you have sufficient cash to start up a potential new position if the need arises. You may also specify that once you open a position of this kind, they must be of a certain size, which is the buy value. You arrive at a buy value that is 95 percent of the current available liquidity.

In the third stage, you may search for any available positions using the symbol of your choice. This method returns a boolean result that indicates whether or not there is an open position for the symbol that was sent in as input.

The fourth stage is the definition of the algorithm’s trading strategy, which is the heart and soul of the algorithm. Orders may be created by using the order API. Specifically, if the shorter EMA crosses over the longer EMA, the algorithm issues a market order for the amount specified in buy value above, indicating a long position.

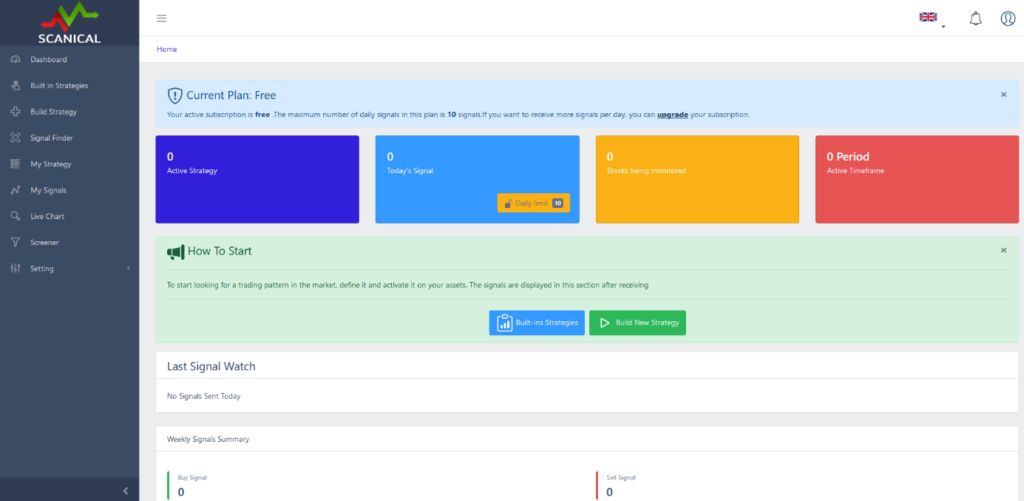

See?! Creating a trading bot by yourself – from zero – is achievable but extraordinarily difficult. Scanical is here to benefit you via managing all your trading strategies, receiving up to 10 signals in Free Mode, and unlimited signals if you upgrade your subscription.

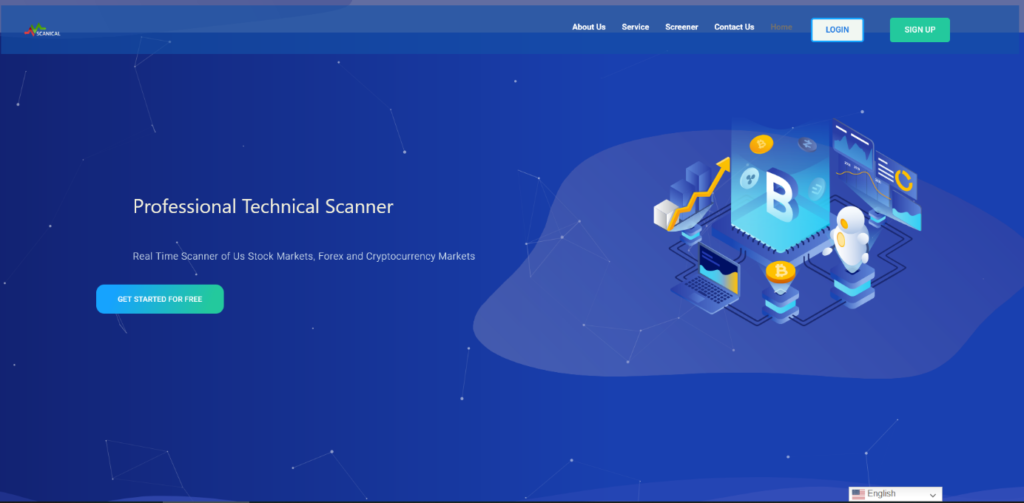

SCANICAL; Your Smart Assistant in Identifying Technical Patterns

We develop algorithmic software that is reliable and can be used to operate completely automated bots around the clock. Scanical is a fully adjustable trading aid that can be tailored to fit both fundamental and technical trading methods alike. Our algorithmic bot programming solutions are designed to meet the specific needs of your business requirements. The services we provide include data-intensive charts, backtesting software, and historical data download, all of which are highly design-driven and end-to-end algorithmic software development.

Our comprehensive software bot development services make it simple to execute arbitrage, market making, and a variety of other statistical tactics. So, before having to create a trading bot with lots of effort, just sit back and let us show you what you may gain if you choose our services.

What Do We Offer?

Our services include stock market scanners, which can keep track of your technical patterns in the marketplace and alert you if something unusual occurs. These services have the capability of scanning timeframes and can be enabled on a limited number of stocks, including those traded on the NASDAQ, the NYSE, and the AMEX markets. One further remarkable aspect of our service is the ability to construct hybrid patterns that include a variety of indicators and are applicable to a variety of timeframes at once.

Free and Monthly-charged Subscriptions

Although you can create a trading bot on Scanical to monitor ten signals per day for free, we also have some available plans for experts. Our services are available as monthly subscriptions, each of which is intended to give a specific collection of signals based on your specific requirements and is priced accordingly.

Your account will be active immediately upon the completion of the registration and payment process. You will have complete control over the creation and implementation of your trading strategy across any number of equities you like. The services will work until they reach the daily signal limit and will alert you if they have discovered the pattern after being activated.

If you are interested in scaling or if you are a day trader, it is preferable to activate a plan that covers a greater signal level. However, with the exception of the signal constraint, all conventional designs include properties that are identical to one another.

Enterprise Subscriptions

If you want a customized service that is tailored even further to your unique requirements, we can provide what we refer to as an Enterprise subscription. In this service, your model and approach will be determined with the assistance of our experienced experts, and our team will custom create a scanner with the features you want. Furthermore, in addition to the monthly membership charge proportionate to your scan level, this service will cost you once to develop and model it at the beginning, after which the templates will be permanently enabled in your account.

Scanical’s Patterns and Strategies

As soon as your account is activated in Scanical, you may choose your ideal approach based on the trading timeframe, the intended direction of your signal, and the sort of pattern you want to trade. If you wish to customize this strategy, go to “My Strategies” and click on “Settings”. From there, you may make changes to it or activate it on more assets.

The signals included in these methods are just for the purpose of familiarizing you with the performance of this strategy, and they have only been applied to a limited number of stocks, which you may increase or decrease according to your specific requirements.

What Signals Are Available in Scanical

For better trading, you may not need to create a trading bot, but you have to use ready-to-go bots like Scanical, which monitor and scan in what you program them. In Scanical, there are so many technical patterns that help you to trade like a winner. Here are some available patterns (signals) in Scanical:

- Stochastic Oscillator Uptrend

- Stochastic Oscillator Downtrend

- Exponential Moving Average

- Simple Moving Average

- Volume-weighted Average Price Uptrend

- Volume-weighted Average Price Downtrend

- Money Flow Index Oversell

- Money Flow Index Overbuy

- Relative Strength Index Overbuy

- Relative Strength Index Oversell

- MACD Buy Trend (MACD-Histogram Crosses Zero-Line)

- MACD Sell Trend (MACD-Histogram Crosses Zero-Line)

- MACD Sell Trend (MACD-Line Crosses Signal-line)

- MACD Buy Trend (Signal-line Crosses MACD-Line)

Connect Your Trading Bot to Binance’s Servers with Scanical

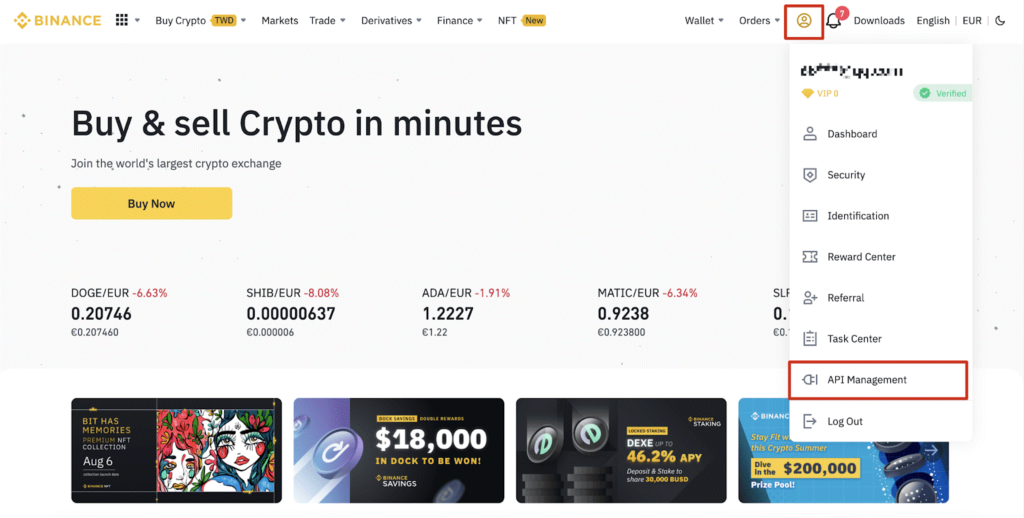

Let’s not talk about how to create a trading bot anymore, and let’s dive deeper into the crypto market. Creating an API enables you to access Binance’s servers from a variety of programming languages, including Python and Java. Data from Binance may be retrieved and interacted with other apps, as well. There are many third-party tools that allow you to examine your current wallet information as well as transaction data, execute trades, and deposit and withdraw coins.

How to Connect Your Smart Assistant Scanical to Binance

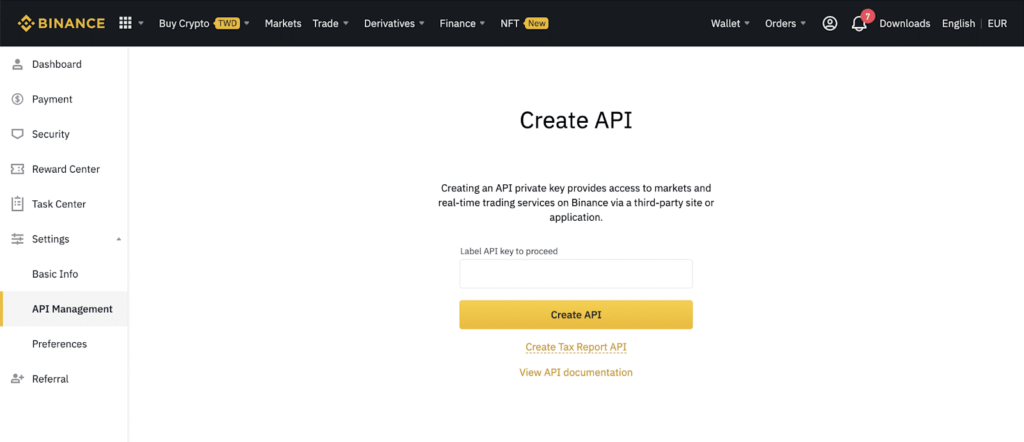

The process of creating an API is straightforward and can be accomplished in about 5 minutes. Upon signing into your Binance account, go to the user center icon and choose [API Management] from the dropdown menu. Create an API key by entering a label or name for it and clicking [Create API]. As a precautionary measure, you should activate two-factor authentication (2FA) on your account before establishing an API endpoint.

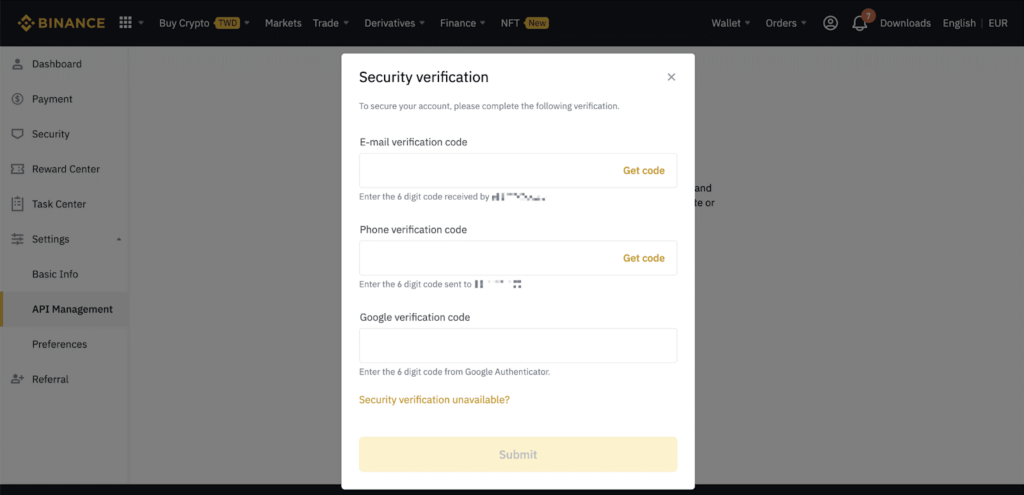

Complete the security verification process using your registered two-factor authentication devices. Your API has now been established. Please keep your Secret Key safe as it will not be revealed to anyone else again. This key should not be shared with anybody. If you lose track of your Secret Key, you’ll have to erase the API and start again from scratch.

Enter the token taken on the site as shown below and click the update button.

After registering, within 24 working hours, you will be given a dedicated IP to connect to the system, and the bot will be connected to Binance.

Scanical Is What You Need for Your Bright Future

Grid trading is a method that makes money from price swings; it works by buying at a low price and selling at a high price within a particular price range. Our scanners and screeners, which operate in the same way as a trading bot, assist you in carrying out this approach around the clock. The stock market monitor may be safely handed over to our sophisticated scanner with the aid of our innovative and powerful helper for technicians or expert market traders.

Our trading bot may assist you in automatically buying cheap and selling high in a certain price range. Even whether you are sleeping, working, or on vacation, the bot continues to work for you.